detalugi.online News

News

Stop Loss For Options

When placing an order to buy or sell a simple option (call or put), either a stop, trailing stop or a profit target order can be attached. Options for Stop Loss Contracts · Run-in and Run-out Protection - for employers transitioning to and from stop loss carriers · Tiered Pooling and Aggregating. A stop-loss order is an order placed with a broker to buy or sell a specific stock once the stock reaches a certain price. Trailing stop-loss and trailing stop-limit orders are advanced order types that automatically adjust according to a security's price movement. A stop-loss order is a market order that helps manage risk by closing your position once the instrument /asset reaches a certain price. A stop order used to limit a loss is called a stop-loss order. Lets go Options Order Flow Rebate. If you are enrolled in our Options Order Flow. Stop loss is selling out of losing position when it is deemed to have little chance of turning around profitably. Tip: Fidelity accepts stop loss orders on equity options between AM and PM ET. Stop orders in the options market work differently than stop orders in. A standard sell-stop order is triggered when an execution occurs at or below the stop price. When this occurs, a market order to sell is executed at the next. When placing an order to buy or sell a simple option (call or put), either a stop, trailing stop or a profit target order can be attached. Options for Stop Loss Contracts · Run-in and Run-out Protection - for employers transitioning to and from stop loss carriers · Tiered Pooling and Aggregating. A stop-loss order is an order placed with a broker to buy or sell a specific stock once the stock reaches a certain price. Trailing stop-loss and trailing stop-limit orders are advanced order types that automatically adjust according to a security's price movement. A stop-loss order is a market order that helps manage risk by closing your position once the instrument /asset reaches a certain price. A stop order used to limit a loss is called a stop-loss order. Lets go Options Order Flow Rebate. If you are enrolled in our Options Order Flow. Stop loss is selling out of losing position when it is deemed to have little chance of turning around profitably. Tip: Fidelity accepts stop loss orders on equity options between AM and PM ET. Stop orders in the options market work differently than stop orders in. A standard sell-stop order is triggered when an execution occurs at or below the stop price. When this occurs, a market order to sell is executed at the next.

A stop loss is a price level where you want to sell your position to avoid further losses. We can say it's a defined price level – mostly set before you. Stop limit orders guarantee the price at which the order could be filled, but they don't guarantee that the order will be filled, because the limit price may. A stop-limit order is a tool that traders use to mitigate trade risks by specifying the highest or lowest price of stocks they are willing to. Once the Index Price touches your stop price, a limit order will automatically be placed to limit buy/sell your order amount. Stop limit orders can be used to. Stop orders can be used to try to lock in a profit rather than limit a 50% loss. If you hold a position that currently shows a profit, you may place a stop. Stop loss coverage protects your organization when catastrophic claims arise. However, not all coverage is the same. Contract terms and conditions can vary. A stop-loss strategy is a method used in investing to limit losses on an investment. By setting a predefined point at which your investment will be sold, you. A hard stop is when a trader puts an actual order out there. I use a market stop, which means the trade becomes a market order to sell or buy once the premium. The purpose of using a Stop Loss order is to limit possible losses on a trade. High Risk Investment Warning: Trading Forex/CFD & Options on margin carries. A stop order, also referred to as a stop-loss order is an order to buy or sell a stock once the price of the stock reaches the specified price, known as the. A common approach is setting a stop loss at a percentage of the option premium or underlying asset's value. Targets can be based on desired. For option sell orders, the stop price triggers by the ask price or a trade at the specific exchange the order rests on, not necessarily the NBBO. When. For option sell orders, the stop price triggers by the ask price or a trade at the specific exchange the order rests on, not necessarily the NBBO. When. Limit stop orders combine the features of stop orders and limit orders. Once a certain predetermined price is reached, the limit stop order acts as a limit. The most effective method of options and stop losses is to know beforehand when you would close the trade and why. A stoploss order is a buy/sell order placed to limit losses when there is a concern that prices may move against the trade. When buying options it is important that you don't risk more than 2% of your trading capital at any one time. If you are taking positions larger than this, it. Imagine that our trader buys an option on a stock and places a stop-loss order 5% below the purchase price. The stock subsequently falls by 5%, triggering the. Take profit and stop loss order is available for options trading on Webull. It is a great option and is a personal choice for day traders to use and avoid losses after a certain price dip. Stop-loss order strategy is often used with the.

What Is Tort In Car Insurance

Full tort policies allow households to receive compensation for ALL damages related to an auto accident. Limited tort entitles you to LESS compensation. Limited Tort and Full Tort refer to different types of coverage under a auto insurance policy and what compensation you are entitled to receive if you are. Pennsylvania law states that full tort coverage gives the injury victim an unrestricted right to seek compensation for injuries from the at-fault driver. This pays for your collision deductible if your insured vehicle is damaged in an accident with an uninsured driver who is at fault. Medical Payments Coverage. your own insurance company, regardless of who is at-fault. However, once an injured person pierces the tort threshold, they may seek recovery for costs not. This means that if you have limited tort, and your minor child is not insured under a separate, full tort policy, the child is bound by your limited tort policy. Tort coverage addresses the ability to file a claim for damages in the event of injuries suffered in a motor vehicle collision. Full tort coverage allows the. This means that if the injured victim in a car accident has uninsured motorist coverage or UM insurance, a claim can be made against your own insurance company. You're able to choose Full Tort – which allows you to sue for pain and suffering – or you can choose Limited Tort and forfeit the right to compensation for pain. Full tort policies allow households to receive compensation for ALL damages related to an auto accident. Limited tort entitles you to LESS compensation. Limited Tort and Full Tort refer to different types of coverage under a auto insurance policy and what compensation you are entitled to receive if you are. Pennsylvania law states that full tort coverage gives the injury victim an unrestricted right to seek compensation for injuries from the at-fault driver. This pays for your collision deductible if your insured vehicle is damaged in an accident with an uninsured driver who is at fault. Medical Payments Coverage. your own insurance company, regardless of who is at-fault. However, once an injured person pierces the tort threshold, they may seek recovery for costs not. This means that if you have limited tort, and your minor child is not insured under a separate, full tort policy, the child is bound by your limited tort policy. Tort coverage addresses the ability to file a claim for damages in the event of injuries suffered in a motor vehicle collision. Full tort coverage allows the. This means that if the injured victim in a car accident has uninsured motorist coverage or UM insurance, a claim can be made against your own insurance company. You're able to choose Full Tort – which allows you to sue for pain and suffering – or you can choose Limited Tort and forfeit the right to compensation for pain.

If you're injured by a driver who does not have any valid car insurance, you will be full tort for your pain and suffering claims against the uninsured. Tort car insurance is a system in which, after an accident, the driver who caused the accident is responsible for covering the cost of medical bills for. Auto insurance is a product that provides financial protection for cars, trucks, motorcycles, and other road vehicles from loss, physical damage and/or bodily. You can choose between a Full Tort option and a cheaper, Limited Tort, option. The key difference between these two options is your ability to sue the at-fault. --No insurer shall cancel, refuse to write or refuse to renew a motor vehicle insurance policy based on the tort option election of the named insured. Any. (1) A person remains subject to tort liability for noneconomic loss caused by his or her ownership, maintenance, or use of a motor vehicle only if the. This liability claim (also called the tort claim) permits the victim to recover compensation for two distinct types of damages: excess economic loss and. PA full/limited tort in PA basically governs when you can get a bodily injury settlement. With full tort you can make a pain and suffering claim. One example of a tort is a car crash. The other driver may not have intended to hit you but due to either inattention or failure to obey highway laws or some. Limited tort severely limits your rights to recovery for injuries caused by an accident. According to the most recent statistics, 51 percent of Pennsylvania. Under “mini-tort,” if you are 50% or more at fault in an accident, and damages to the other driver's car are not completely covered by his or her insurance. Individuals who now purchase insurance in Pennsylvania are classified as either “limited tort” or “full tort.” Tort is a legal term meaning “civil wrongdoing –. If you chose limited tort insurance, you are limited to recovering only the total of your medical bills and lost wages. That's it. You will not be allowed to. Full tort coverage allows that individual to make a claim for pain and suffering. The injuries DO NOT have to be severe to recover damages. What Is “Mini-Tort?” Under Michigan's auto insurance law, a driver can be personally sued only under certain circumstances. One such circumstance is limited. What Is Tort Insurance? Tort insurance is a type of auto insurance coverage that gives Pennsylvania drivers the right to sue the at-fault driver after being. This liability claim (also called the tort claim) permits the victim to recover compensation for two distinct types of damages: excess economic loss and. Liability Insurance covers medical expenses and damages to another person's property as a result of a car accident caused by the insured's negligence. If you. Ed Capozzi: Limited tort is an option that's given to you on your insurance policy. So, in other words, when you purchase auto insurance, you typically get a. You can choose between a Full Tort option and a cheaper, Limited Tort, option. The key difference between these two options is your ability to sue the at-fault.

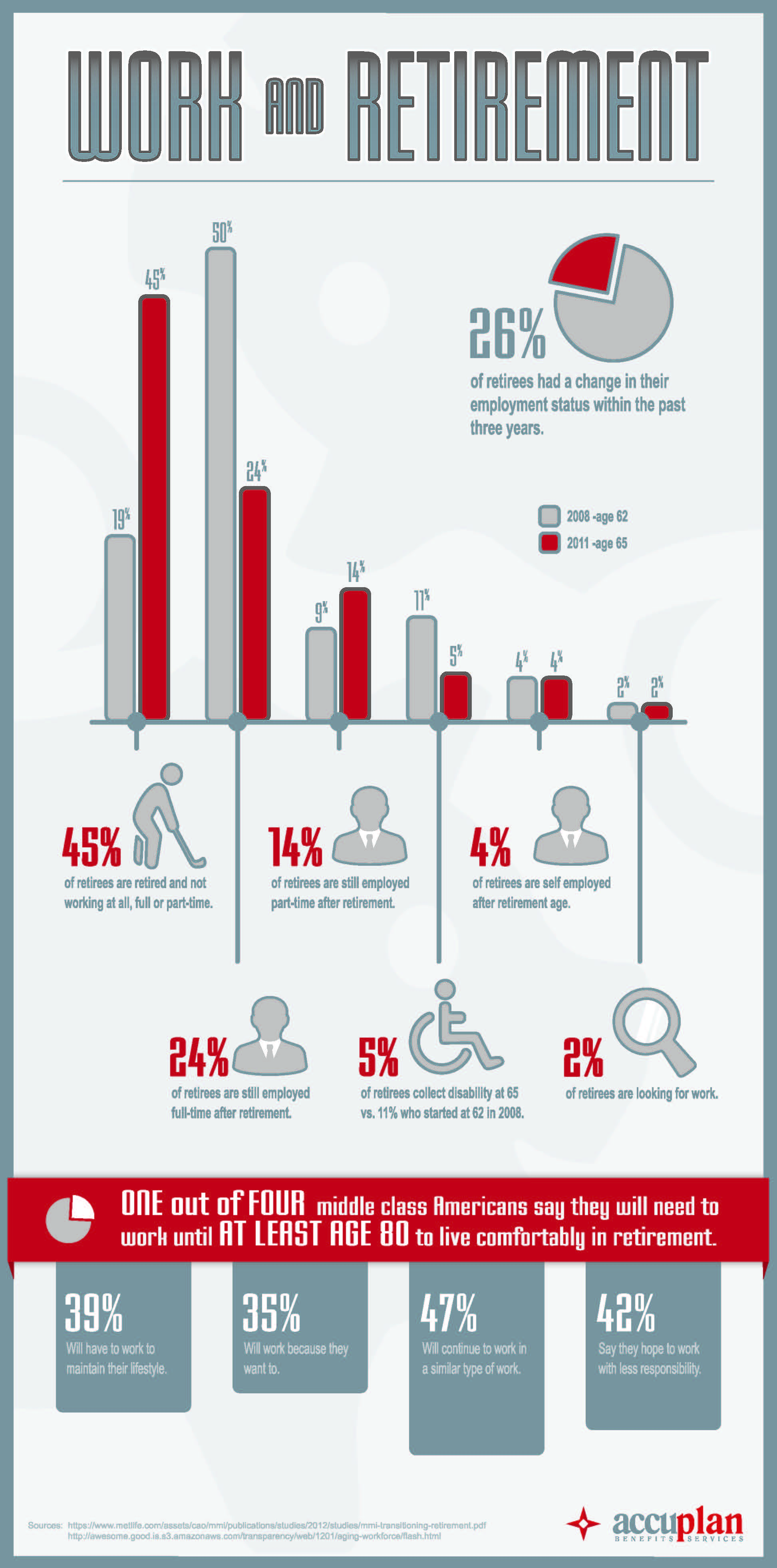

What Do I Need To Know About Retirement

Retirement planning begins with determining your long-term financial goals and tolerance for risk, and then starting to take action to reach those goals. The last thing you want in retirement is to be forced to penny-pinch. Identify places in your budget where you might save money in retirement. For example, if. #1: Find out where you stand. · #2: Boost your savings, if you need to. · #3: Plan ahead for Social Security. · #4: Consider tax-smart strategies now. · #5: Get a. Start saving today to help meet your retirement goals · Step 1: Focus on your emergency savings first · Step 2: Ensure your debt is manageable · Step 3: Take part. 5 Factors That Will Impact How Much You Need for Retirement · 1. Inflation · 2. Cost of Living · 3. Health Care Expenses · 4. Social Security · 5. Your Lifestyle. How to know when to retire: 6 signs you're ready · 1. You are financially prepared for retirement. · 2. You have a Social Security distribution strategy for. What does “retirement” mean? For us, retiring means getting your Social. Security retirement benefit. It might mean that you've also stopped working. However. Do you plan to work part time in retirement? Travel a lot? At what age do you plan to retire? Answers to all these questions will help you figure out how large. First things first—you need to know where you stand financially. Make a list of every stock, savings balance, source of income and insurance policy. Retirement planning begins with determining your long-term financial goals and tolerance for risk, and then starting to take action to reach those goals. The last thing you want in retirement is to be forced to penny-pinch. Identify places in your budget where you might save money in retirement. For example, if. #1: Find out where you stand. · #2: Boost your savings, if you need to. · #3: Plan ahead for Social Security. · #4: Consider tax-smart strategies now. · #5: Get a. Start saving today to help meet your retirement goals · Step 1: Focus on your emergency savings first · Step 2: Ensure your debt is manageable · Step 3: Take part. 5 Factors That Will Impact How Much You Need for Retirement · 1. Inflation · 2. Cost of Living · 3. Health Care Expenses · 4. Social Security · 5. Your Lifestyle. How to know when to retire: 6 signs you're ready · 1. You are financially prepared for retirement. · 2. You have a Social Security distribution strategy for. What does “retirement” mean? For us, retiring means getting your Social. Security retirement benefit. It might mean that you've also stopped working. However. Do you plan to work part time in retirement? Travel a lot? At what age do you plan to retire? Answers to all these questions will help you figure out how large. First things first—you need to know where you stand financially. Make a list of every stock, savings balance, source of income and insurance policy.

18 – 12 Months Before You Retire · Estimate What Your Pension Will Be · Learn how divorce can affect your pension. Required minimum distribution (RMD). Minimum amount you may need to annually withdraw from your retirement plan after age · IRAs. Find how to make tax-. Key Takeaways · Periodically checking your retirement plan, especially during periods of market volatility, can help ensure you're on track to meet your goals. Get retirement planning tools. Learn how Social Security and Medicare work, how to estimate benefits, and how to apply. Find food programs for older adults. This booklet helps you understand your plan and explains what information you should review periodically and where to go for help with questions. 1. Know when you can access your super · 2. Consider how much you'll need for your retirement · 3. Understand your retirement income options · 4. Check your. Book overview · How to get started with your retirement savings · Why saving is more important than investing · How much you should save for retirement · How to. Social Security Benefits and Retirement Savings Are Taxable · Sponsored Content Dianomi · Retirees Get a Lot of Tax Breaks · Sponsored Content Dianomi Learn how much you may need to retire, how tax-advantaged retirement accounts work, and more. Step 1: Have a vision of what your retirement looks like · Step 2: Estimate your post-retirement cost of living · Step 3: Know your future health care expenses. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. 18 – 12 Months Before You Retire · Estimate What Your Pension Will Be · Learn how divorce can affect your pension. you may need up to 80% of your current annual income to retire comfortably? the average monthly benefit paid by the Social Security Administration is $1,? When considering your retirement lifestyle, a common guideline is to replace 70% of your annual income before your retirement. You can plan to do this through a. What will your income sources be in retirement? · Do you know when you want to begin taking Social Security and how the age at which you begin receiving payments. The timing is up to you and should be based on your own personal needs. Get an estimate. Get an estimate. Check your Social Security account to see how much. If you plan to retire within the next 10 years or so, consider taking these steps today to help in your efforts toward having what you need to enjoy a. Investing for Retirement ; Find Old (k)s and More Money You've Forgotten About. The answers can help you retire more comfortably ; 5 Things to Know About. How much do you need to retire? Many financial advisors boil the answer down to another rule of thumb: the 4% sustainable withdrawal rate. This is the amount. Don't know where to start? You've come to the right place. You probably have a lot of questions about saving for retirement. How much will I need? What.

How To Put Money Into A Mutual Fund

What Are Mutual Funds? A mutual fund is an investment company that takes money from many investors and pools it together in one large pot. The professional. You can invest in mutual funds by submitting an application form with a cheque or bank draft at the branch office, Investor Service Centres (ISC). What is a mutual fund? Mutual funds let you pool your money with other investors to "mutually" buy stocks, bonds, and other investments. Mutual funds are purchased through a brokerage account. You could also buy them in an IRA. When you're buying into a fund, you're pooling your money with other. A mutual fund pools money from many investors and invests it in securities, such as stocks, bonds, or other assets. Find a professionally managed mutual fund. U.S. News has ranked more than mutual funds. Rankings that combine expert analyst opinions and fund-level. Therefore, each time you want to invest more money in a mutual fund, you will need to place a trade to buy the mutual fund for whatever price it. It is important to work with your Financial Advisor to determine which funds and share classes are available for purchase in your account. Before you invest, be. Because mutual funds invest in a variety of different assets, income can be earned from dividends on stocks and interest on bonds held within the fund's. What Are Mutual Funds? A mutual fund is an investment company that takes money from many investors and pools it together in one large pot. The professional. You can invest in mutual funds by submitting an application form with a cheque or bank draft at the branch office, Investor Service Centres (ISC). What is a mutual fund? Mutual funds let you pool your money with other investors to "mutually" buy stocks, bonds, and other investments. Mutual funds are purchased through a brokerage account. You could also buy them in an IRA. When you're buying into a fund, you're pooling your money with other. A mutual fund pools money from many investors and invests it in securities, such as stocks, bonds, or other assets. Find a professionally managed mutual fund. U.S. News has ranked more than mutual funds. Rankings that combine expert analyst opinions and fund-level. Therefore, each time you want to invest more money in a mutual fund, you will need to place a trade to buy the mutual fund for whatever price it. It is important to work with your Financial Advisor to determine which funds and share classes are available for purchase in your account. Before you invest, be. Because mutual funds invest in a variety of different assets, income can be earned from dividends on stocks and interest on bonds held within the fund's.

Mutual funds make for a simple and efficient way to diversify your portfolio. E*TRADE offers thousands of leading mutual funds to choose from. The primary goal for growth funds is capital appreciation. If you plan to invest to meet a long-term need and can handle a fair amount of risk and volatility, a. Thrivent Mutual Funds offers actively-managed no load mutual funds, including asset allocation, income plus, equity, and fixed income funds. A mutual fund is a type of investment that pools separate investors' money into a large basket. A fund manager makes investment decisions with the entire amount. Mutual funds work by pooling money from multiple investors to purchase stocks, bonds and other securities. Because they draw from a collection of companies. Step 1: Decide which mutual funds to buy. Explore different types of mutual funds. Step 2: Choose an account type based on your savings goal. On the Transfer Money/Shares page, select My Bank Account (Fidelity Electronic Funds Transfer) from the From drop-down list. Select the mutual fund account in. You generally have the option of receiving these distributions in cash or having them automatically reinvested in the fund to increase the number of shares you. There are three main reasons to invest in mutual funds: Diversification – In today's volatile economy, spreading assets among different investments may help. For instance, most mutual funds hold well over securities. For someone with a small sum to invest, building and managing a portfolio containing that many. How to buy and sell mutual funds. Investors buy mutual fund shares from the fund itself or through a broker for the fund, rather than from other investors. The. For example, some index funds invest in all of the companies included in an index; other index funds invest in a representative sample of the companies included. Once you've made the election to move money into the mutual fund window, you independently select which mutual funds you want to invest in with that money. When investors buy shares in the fund, the mutual fund company pools that money to make investments on their behalf. In fact, mutual funds can invest in a. When you invest in a mutual fund, your money is pooled with other investors to purchase shares of different securities. Funds have different investment. What Are Mutual Funds? A mutual fund is an investment company that takes money from many investors and pools it together in one large pot. The professional. Often described as “cash alternatives,” these funds, by law, can invest only in certain high-quality, short-term investments with maturities of less than Merrill Edge Select™ Funds. The Merrill screening process takes the guesswork out of finding quality funds for investors with a self-directed account. Taking. Fidelity's FundsNetwork allows you to invest in mutual funds from hundreds of fund companies outside of Fidelity, including many available with no transaction. Don't put all your eggs in one basket Mutual funds are comprised of multiple investments in one fund. This can provide lower risk through diversification and.

Lkq Chicago

LKQ Pick Your Part - Chicago South We update our salvage yard daily with the largest selection of used vehicles to pick and pull OEM used auto parts. Repair every crack, dent, and scratch. Take your set of wheels to the body shop professionals at LKQ Pick Your Part Chicago for reputable, reliable. S. St Louis Ave. Chicago, IL Set As Store. Find company research, competitor information, contact details & financial data for LKQ Corporation of Chicago, IL. Get the latest business insights from. LKQ Salaries trends. 41 salaries for 33 jobs at LKQ in Chicago. Salaries posted anonymously by LKQ employees in Chicago. LKQ CORPORATION, West Madison St, Ste , Chicago, IL , Mon - am - pm, Tue - am - pm, Wed - am - pm. LKQ Pick Your Part – Chicago Heights. Contact: East Lincoln Highway, Chicago Heights, IL Phone: () Realtime driving directions to LKQ Pick Your Part, W North Ave, Chicago, based on live traffic updates and road conditions – from Waze fellow drivers. Find the used auto parts you need at LKQ Pick Your Part - Chicago South with our online part finder tool. Search all our vehicles for the part that fits. LKQ Pick Your Part - Chicago South We update our salvage yard daily with the largest selection of used vehicles to pick and pull OEM used auto parts. Repair every crack, dent, and scratch. Take your set of wheels to the body shop professionals at LKQ Pick Your Part Chicago for reputable, reliable. S. St Louis Ave. Chicago, IL Set As Store. Find company research, competitor information, contact details & financial data for LKQ Corporation of Chicago, IL. Get the latest business insights from. LKQ Salaries trends. 41 salaries for 33 jobs at LKQ in Chicago. Salaries posted anonymously by LKQ employees in Chicago. LKQ CORPORATION, West Madison St, Ste , Chicago, IL , Mon - am - pm, Tue - am - pm, Wed - am - pm. LKQ Pick Your Part – Chicago Heights. Contact: East Lincoln Highway, Chicago Heights, IL Phone: () Realtime driving directions to LKQ Pick Your Part, W North Ave, Chicago, based on live traffic updates and road conditions – from Waze fellow drivers. Find the used auto parts you need at LKQ Pick Your Part - Chicago South with our online part finder tool. Search all our vehicles for the part that fits.

Find Your Parts Prices Sell Your Car Locations About Us Careers Pyp garage Find a location near you LKQ Pick Your Part in Chicago, Illinois. Hours & Info; Find. LKQ Pick Your Part - Chicago. W. North Avenue, Chicago, Illinois Automotive Parts Store•33 posts. $$$$•Opens in 45 minutes. LKQ Pick Your Part - Chicago South is your one-stop shop for all your used auto parts needs in the Chicago, IL area. Our MoreLKQ Pick Your Part - Chicago. LKQ Corporation Scrap Yard. Recycling Centers in West Madison Street,Suite ,Chicago,Illinois, United States-ZIP River Road,,York Haven. Find the used auto parts you need at LKQ Pick Your Part - Chicago with our online part finder tool. Search all our vehicles for the part that fits. Followers, Following, Posts - LKQ Pick Your Part Chicago (@lkqpypchicago) on Instagram: "With over 80 salvage yards across the nation, LKQ Pick. Employees in Chicago have rated LKQ with out of 5 stars in 30 anonymous Glassdoor reviews. To compare, worldwide LKQ employees have given a rating of LKQ Pick Your Part - Chicago. W North Ave. Chicago, IL mi. Set As Store. Yermo the Octopus Hours & Info; Magnifying Glass Find Your Parts. What are the most popular jobs at Lkq? · Buyer · Delivery Driver · Dismantler · Warehouse Delivery Driver · Warehouse Worker · Human Resources Manager · Systems. Auto Parts and Accessories in East Lincoln Hwy, Chicago Heights, IL LKQ Pick Your Part - Chicago. W North Ave. Chicago, IL mi. Set As Store. Yermo the Octopus Hours & Info; Magnifying Glass Find Your Parts. detalugi.online LKQ Pick Your Part - Chicago South is your one-stop shop for all your used auto parts needs in the Chicago, IL area. detalugi.online External link for LKQ Corporation. Industry: Automotive. Company size: 10,+ employees. Headquarters: Chicago, Illinois. Type: Public. 6 Lkq jobs available in Chicago, IL on detalugi.online Apply to Outside Sales Representative, Warehouse Associate, Warehouse Worker and more! Get more information for LKQ Corporation in Chicago, IL. See reviews, map, get the address, and find directions. LKQ Pick Your Part - Chicago South LKQ Pick Your Part - Chicago South is your one-stop shop for all your used auto parts needs in the Chicago, IL area. Pick. LKQ is not associated with or sponsored by the automotive brands listed above and merely provides aftermarket and recycled parts for these brands. Also of. LKQ Corp. fell the most in 10 months after short-seller Prescience Point Research Group said the auto-parts repair service has exaggerated revenue growth. Lkq Corporation, Tradestyle: Lkq. Top Contact: Restricted, Title: Restricted. Street Address: W Madison St Ste , Chicago IL Phone: Restricted. LKQ Pick Your Part has the largest selection of affordable used auto parts in Chicago. Our yard is stocked with the best selection of Domestic, Imports.

How Do Option Calls And Puts Work

What are call options and put options contracts? A call option gives the contract owner/holder (the buyer of the call option) the right to buy the underlying. If there were no such thing as puts, the only way to benefit from a downward movement in the market would be to sell stock short. Buying the LEAPS call gives. When you write an option, you're the person on the other end of the transaction. For example, if you write a call, the buyer could choose to exercise it if the. A call option is in-the-money when the underlying security's price is higher than the strike price. For illustrative purposes only. Intrinsic Value (Puts). A. Puts and Calls are the only two types of stock option contracts and they are the key to understanding stock options trading. In this lesson you'll learn how. > CALL Option: Gives the owner the right, but not the obligation, to buy a particular asset at a specific price, on or before a certain time. > PUT Option. A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an. A put option is a contract that gives the owner the right, without any obligation, to sell the equivalent of shares of an underlying asset at a. An option contract can be a Call Option or Put Option. A call option comes with a right to buy the underlying asset at a pre-agreed price on a future date. What are call options and put options contracts? A call option gives the contract owner/holder (the buyer of the call option) the right to buy the underlying. If there were no such thing as puts, the only way to benefit from a downward movement in the market would be to sell stock short. Buying the LEAPS call gives. When you write an option, you're the person on the other end of the transaction. For example, if you write a call, the buyer could choose to exercise it if the. A call option is in-the-money when the underlying security's price is higher than the strike price. For illustrative purposes only. Intrinsic Value (Puts). A. Puts and Calls are the only two types of stock option contracts and they are the key to understanding stock options trading. In this lesson you'll learn how. > CALL Option: Gives the owner the right, but not the obligation, to buy a particular asset at a specific price, on or before a certain time. > PUT Option. A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an. A put option is a contract that gives the owner the right, without any obligation, to sell the equivalent of shares of an underlying asset at a. An option contract can be a Call Option or Put Option. A call option comes with a right to buy the underlying asset at a pre-agreed price on a future date.

On the contrary, a put option is the right to sell the underlying stock at a predetermined price until a fixed expiry date. While a call option buyer has the. When you buy an option, you pay for the right to exercise it, but you have no obligation to do so. When you sell an option, it's the opposite—you collect. Call options give the holder the right – but not the obligation – to buy something at a specific price for a specific time period. · Put options give the holder. Put options give holders of the option the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a. An option is a derivative contract that gives the holder the right, but not the obligation, to buy or sell an asset by a certain date at a specified price. A put option provides you with the right to sell a security at a set price until a particular date. It gives you the option of turning down the security. A put option is a contract that allows someone to sell shares at a certain price at a specified time in the future. The seller of the put option has the. call option and put option to reduce the complexity as they appear. Investors should know the following three terms to understand the working of an option. A put option allows the holder to sell an asset at a specified price before a specified date. An example would be to purchase a Rs. put option on Stock X. Puts work on the other end of the spectrum. When you buy a put, you're reserving the right to sell shares at, hopefully, a higher price than they are trading at. What are call options? A call option is a contract between a buyer and a seller to purchase a certain stock at a certain price up until a defined expiration. What Are Call Options and How Do They Work? 3 Examples · Call options give buyers the right, but not the obligation, to buy a stock for a fixed price, on or. In options trading, a put option provides the holder with the right to sell the underlying asset at a predetermined price before the expiration date. For the. For put options, intrinsic value is calculated by subtracting the underlying price from the strike price. So, that is how the logic of ITM and OTM for call and. Selling an option makes sense when you expect the market to remain flat or below the strike price (in case of calls) or above strike price (in case of put. A put option gives the right to an investor, but not an obligation, to sell a particular stock at a predetermined rate on the expiration date. Call option in. A put option is a stock-related contract. The contract entitles you to sell the stock at the strike price, is purchased for a premium. Until the contract's. A call option gives the buyer the right—but not the obligation—to purchase shares of the underlying stock at a set price (called the strike price or. Although the option may change hands multiple times, it's the writer who remains responsible to fulfill the contract and buy the stock. Writing options provide. Call option buyers profit when the stock price rises well past their strike price ITM before or at the expiration of their contract. On the other hand, call.

Cloud Computing Business Intelligence

Turn data into insights with Sigma Computing, a cloud-based Business Intelligence (BI) platform. Elevate business decisions by analyzing data at scale for. Now, let's delve into a comprehensive examination of the benefits offered by cloud-based business intelligence. How you can benefit from BI on cloud computing. Business intelligence (BI) is the process of using the power of people and technologies to collect and analyze data to be used by organizations. According to Gartner, investment in cloud computing is projected to grow 17% in to total $ billion (up from $ billion in ). e-Zest Cloud Computing Services allows you to deploy your BI applications on cloud. Moving to cloud brings with it the scalability, elasticity and cost-. In more straightforward terms, Cloud computing refers to delivering computing services over the cloud (internet). Computing services encompass databases. Cloud business intelligence (cloud BI) delivers the right information to the right people from anywhere and enables business to have a remote workforce. How to measure cloud computing options and benefits to impact business intelligence infrastructure This book is a guide for managers and others involved in. Today, businesses have access to massive amounts of data they can use to derive business intelligence (BI) for faster, better decision-making. Turn data into insights with Sigma Computing, a cloud-based Business Intelligence (BI) platform. Elevate business decisions by analyzing data at scale for. Now, let's delve into a comprehensive examination of the benefits offered by cloud-based business intelligence. How you can benefit from BI on cloud computing. Business intelligence (BI) is the process of using the power of people and technologies to collect and analyze data to be used by organizations. According to Gartner, investment in cloud computing is projected to grow 17% in to total $ billion (up from $ billion in ). e-Zest Cloud Computing Services allows you to deploy your BI applications on cloud. Moving to cloud brings with it the scalability, elasticity and cost-. In more straightforward terms, Cloud computing refers to delivering computing services over the cloud (internet). Computing services encompass databases. Cloud business intelligence (cloud BI) delivers the right information to the right people from anywhere and enables business to have a remote workforce. How to measure cloud computing options and benefits to impact business intelligence infrastructure This book is a guide for managers and others involved in. Today, businesses have access to massive amounts of data they can use to derive business intelligence (BI) for faster, better decision-making.

Cloud BI is the merger of cloud computing and ERP (Enterprise Resource Planning) that delivers simpler data predictive models, visualizations, multi-source. The emergence of cloud computing technology has instigated a notable evolution in BI solutions. Cloud computing and business intelligence complement each other. detalugi.online: Impacts and Challenges of Cloud Business Intelligence (Advances in Systems Analysis, Software Engineering, and High Performance Computing). Environmental Sustainability. Cloud computing generally consumes less energy compared to traditional on-premises data centers. By leveraging Cloud BI solutions. Cloud BI combines cloud computing and business intelligence, which is leveraged to transform company data into insightful information within a cloud ecosystem. Cloud-based Business Intelligence (BI) software is a type of BI software that is hosted and managed by a third-party provider on a cloud computing platform. market-leading innovation in the cloud computing and software sectors. For a detailed breakdown of all the benefits you receive as an awards entrant as. Cloud computing is gradually gaining popularity among businesses due to its distinct advantages over self-hosted IT infrastructures. Business Intelligence. That was before the revolution of cloud computing: according to the IDG Cloud computing study, at least 92% of companies use the cloud for their IT. cloud BI is fewer than Adoption of private cloud computing inside the enterprise is being driven by the benefits of scalability and reduced total cost. The integration of BI and cloud computing opens doors to predictive analytics, empowering businesses to forecast trends and make proactive decisions. With Cloud Computing fast becoming the next big thing in IT, the jury is still out on how it can best be matched up with Business Intelligence (BI) to deliver. Cloud computing and business intelligence are two technologies that can work together to provide businesses with powerful insights into their data. Which one is better for my open elective choice, business intelligence or cloud computing? Business intelligence (BI) is the set of. In the concept of cloud business intelligence, cloud computing serves as a platform for data like dashboards, KPIs, and other business analytics. It allows BI. In cloud BI architecture, cloud computing serves as a vault for a large amount of data, such as dashboards, KPIs, and other types of business analytics. It also. Explore the compelling advantages of cloud-based Business Intelligence tools Switching to cloud computing significantly cuts energy use, as a study. In today's rapidly evolving business landscape, the integration of cloud computing with analytics and business intelligence (BI) has become. Winners announced for Stratus Awards presented by Business Intelligence Group. Google Cloud's uniquely powerful and flexible BI modernization solutions help you develop a strategy to modernize BI and put data at the center of your.

Use Home Equity To Pay Off Credit Card Debt

From experience I can tell that a HELOC is more dangerous than a credit card as it has A LOT OF MONEY THERE and you will be tempted to use it. A Home Equity Line of Credit can help homeowners pay off debt with a low interest rate and interest-only minimum payments. A home equity loan may be a lower interest rate than your current debt, but make sure you know all the risks before consolidating your debt into one. You can borrow money using the equity in your home with a home equity loan, which typically has better conditions for repayment than credit cards and lower. Ultimately, use HELOCs to pay off debt when you can reduce your interest charges and fees. This is why HELOCs are ideal for paying off credit card debt. Using a HELOC to consolidate credit card debt allows you to consolidate payments into one monthly payment. PLUS, chances are a HELOC will offer a lower APR than. Benefits of using a home equity loan to pay off credit card debt · They offer lower interest rates than credit cards. · They have a long repayment period. · You'll. Lower interest rates can be very attractive if you're planning to use the funds to pay down or consolidate other debts. For example, if you use a home equity. HELOC is lower interest by a very wide margin. Also not bad for your credit history when you pay it and getting the credit card balances down. From experience I can tell that a HELOC is more dangerous than a credit card as it has A LOT OF MONEY THERE and you will be tempted to use it. A Home Equity Line of Credit can help homeowners pay off debt with a low interest rate and interest-only minimum payments. A home equity loan may be a lower interest rate than your current debt, but make sure you know all the risks before consolidating your debt into one. You can borrow money using the equity in your home with a home equity loan, which typically has better conditions for repayment than credit cards and lower. Ultimately, use HELOCs to pay off debt when you can reduce your interest charges and fees. This is why HELOCs are ideal for paying off credit card debt. Using a HELOC to consolidate credit card debt allows you to consolidate payments into one monthly payment. PLUS, chances are a HELOC will offer a lower APR than. Benefits of using a home equity loan to pay off credit card debt · They offer lower interest rates than credit cards. · They have a long repayment period. · You'll. Lower interest rates can be very attractive if you're planning to use the funds to pay down or consolidate other debts. For example, if you use a home equity. HELOC is lower interest by a very wide margin. Also not bad for your credit history when you pay it and getting the credit card balances down.

Taking out a home equity loan to consolidate debt can be one of the most cost-effective ways to pay off that debt. When you take out a home equity loan to pay off your credit cards, you are reducing your interest rate but you are also turning an unsecured debt into a secured. If you decide not to take the HELOC because of a change in terms from what you expected, the lender must return all of the fees you paid. Lenders also must give. Funding a student loan for yourself or your child · Paying off or consolidating credit card debt · Funding a vacation · Paying for weddings or important. One common use of HELOC funds is to consolidate credit card debt or pay off other high-interest debts. As mentioned, HELOCs traditionally carry lower interest. A HELOC has what's called a draw period, usually between five and 10 years, when you can borrow the money and pay it back to borrow again — similar to a credit. What Is the Best Way to Consolidate Debt? Using a home equity loan to pay off debts is not an ideal route for everyone. Most home equity loans come with. So, using your mortgage to pay off high-interest credit card debt may lead to serious interest savings over time. Remember that refinancing is not available for. A HEA puts that equity to use. In exchange for a percentage of your home's equity, a HEA provider gives you a lump sum cash payment. You then get to use that. So, using your mortgage to pay off high-interest credit card debt may lead to serious interest savings over time. Remember that refinancing is not available for. Using home equity to pay off debt means replacing one kind of debt with another. This can make sense if the debt you repay is more costly than. Using home equity to pay off debt means replacing one kind of debt with another. This can make sense if the debt you repay is more costly than. Your HELOC can be a smart way to manage your finances. You can use it to pay off higher-interest debts, and then just focus on making one monthly payment at a. You don't need to sell the home you love in order to take advantage of your home equity. With a home equity investment, you can eliminate credit card debt and. Use a HELOC for debt consolidation and reduce multiple credit cards or several loans into one payment, often with a lower interest rate. Consolidate debt · Transfer balances. Take advantage of a low balance transfer rate to move debt off high-interest cards. · Tap into your home equity. If you have. A HELOC works similarly to a credit card. The lender provides a maximum borrowing limit, and you can draw funds as needed, only paying interest on the amount. A home equity loan is a good option to pay down your credit card debts as long as you know the risks and are sure that you can afford the payment plan. If you. Yes, you can use home equity to consolidate debt. This can increase your cash flow on a monthly basis and help rebuild credit scores. Through a cash-out refinance, home equity line of credit (HELOC), or home equity loan (HELOAN) you can pay off your debt or consolidate multiple credit card.

Vanguard Sp 500

The Fund employs an indexing investment approach designed to track the performance of the Standard & Poor's (S&P) Index (the Index), a widely recognized. Vanguard S&P Value Index Fund Institutional Shares (VSPVX) - Find objective, share price, performance, expense ratio, holding, and risk details. Index Fund seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. An easy way to get Vanguard S&P ETF real-time prices. View live VOO stock fund chart, financials, and market news. Get the latest Vanguard S&P Index ETF (VFV) real-time quote, historical performance, charts, and other financial information to help you make more. Learn everything you need to know about Vanguard S&P ETF (VOO) and how it ranks compared to other funds. Research performance, expense ratio, holdings. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor's Index, a widely recognized benchmark of U.S. Get Vanguard S&P ETF (VOO:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. VOO Portfolio - Learn more about the Vanguard S&P ETF investment portfolio including asset allocation, stock style, stock holdings and more. The Fund employs an indexing investment approach designed to track the performance of the Standard & Poor's (S&P) Index (the Index), a widely recognized. Vanguard S&P Value Index Fund Institutional Shares (VSPVX) - Find objective, share price, performance, expense ratio, holding, and risk details. Index Fund seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. An easy way to get Vanguard S&P ETF real-time prices. View live VOO stock fund chart, financials, and market news. Get the latest Vanguard S&P Index ETF (VFV) real-time quote, historical performance, charts, and other financial information to help you make more. Learn everything you need to know about Vanguard S&P ETF (VOO) and how it ranks compared to other funds. Research performance, expense ratio, holdings. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor's Index, a widely recognized benchmark of U.S. Get Vanguard S&P ETF (VOO:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. VOO Portfolio - Learn more about the Vanguard S&P ETF investment portfolio including asset allocation, stock style, stock holdings and more.

S&P UCITS ETF - (USD) Accumulating (VUAA) You can learn more about Vanguard's use of your data by reading ourprivacy policy andcookie policy. Vanguard Index Fund Investor Shares (VFINX) - Find objective, share price, performance, expense ratio, holding, and risk details. View the latest Vanguard S&P ETF (VOO) stock price and news, and other vital information for better exchange traded fund investing. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor's Index, a widely recognized benchmark of U.S. The Fund seeks to track the performance of its benchmark index, the S&P The Fund employs an indexing investment approach. The Fund attempts to replicate. The fund managers attempt to replicate the performance of the S&P , with the major difference being the fund's low expense ratio. The fund falls into. VOO Performance - Review the performance history of the Vanguard S&P ETF to see it's current status, yearly returns, and dividend history. S&P ETF. EXPENSE RATIO. %. As of04/26/ TOTAL ASSETS. $T. As of S&P Index. Overview. Performance & Price. Fees & Costs. Portfolio. Complete Vanguard S&P ETF funds overview by Barron's. View the VOO funds market news. Is Vanguard S&P UCITS ETF (USD) Accumulating paying dividends? Vanguard S&P UCITS ETF (USD) Accumulating is an accumulating ETF. This means that. Seeks to track the performance of the S&P Index. U.S. large-cap equity diversified across growth and value styles. Passively managed. S&P UCITS ETF - (USD) Distributing (VUSA) · About this fund · Performance · Portfolio data · Prices and distribution · Purchase information. Get the latest Vanguard S&P ETF (VOO) real-time quote, historical performance, charts, and other financial information to help you make more informed. Learn everything about Vanguard S&P ETF (VOO). News, analyses, holdings, benchmarks, and quotes. Vanguard S&P ETF is an exchange-traded fund incorporated in the USA. The ETF tracks the performance of the S&P Index. The ETF primarily holds large-cap. Schwab S&P Index Fund; Shelton NASDAQ Index Direct; Invesco QQQ Trust ETF; Vanguard Russell ETF; Vanguard Total Stock Market ETF; SPDR Dow Jones. View Vanguard S&P ETF (VOO) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Find here information about the Vanguard S&P ETF (VOO). Assess the VOO stock price quote today as well as the premarket and after hours trading prices. What. Trading Investment approach. We're having trouble locating this data, try again later. Seeks to track the performance of the S&P Index. Interactive Chart for Vanguard S&P ETF (VOO), analyze all the data with a huge range of indicators.

Safety Cryptocurrency

Using a cryptocurrency exchange to store or exchange your fiat and digital assets can be extremely risky. In some cases, users have discovered that their assets. Cryptocurrency Security Measures · Cold Wallet is a better option as it is not connected to the internet. · Using secured Internet Network · Maintaining. Crypto Exchange Security: Exchange security includes measures to protect user accounts, secure storage of assets, two-factor authentication (2FA), anti-money. The U.S. dollar was considered a “commodity currency” and was backed by gold until Safety and security. Keeping your money in a bank or financial. Crypto as an asset class is highly volatile, can become illiquid at any time, and is for investors with a high risk tolerance. Crypto may also be more. Digital, Distribution, Diversity, Executive, Family Officer, Finance, Human Resources, Information Security, Information Technology, Internal Audit, Investments. cryptocurrency scams or detect cryptocurrency accounts that may be compromised. They might say to send it to a wallet address they give you — for “safe. If the project fails, your investment will likely be worth nothing. If the project is a fraud, the anonymous nature of cryptocurrency means that it could be. With the rise in the adoption of digital currencies, Mastercard provides crypto services that are designed to enhance trust & security when people shop. Using a cryptocurrency exchange to store or exchange your fiat and digital assets can be extremely risky. In some cases, users have discovered that their assets. Cryptocurrency Security Measures · Cold Wallet is a better option as it is not connected to the internet. · Using secured Internet Network · Maintaining. Crypto Exchange Security: Exchange security includes measures to protect user accounts, secure storage of assets, two-factor authentication (2FA), anti-money. The U.S. dollar was considered a “commodity currency” and was backed by gold until Safety and security. Keeping your money in a bank or financial. Crypto as an asset class is highly volatile, can become illiquid at any time, and is for investors with a high risk tolerance. Crypto may also be more. Digital, Distribution, Diversity, Executive, Family Officer, Finance, Human Resources, Information Security, Information Technology, Internal Audit, Investments. cryptocurrency scams or detect cryptocurrency accounts that may be compromised. They might say to send it to a wallet address they give you — for “safe. If the project fails, your investment will likely be worth nothing. If the project is a fraud, the anonymous nature of cryptocurrency means that it could be. With the rise in the adoption of digital currencies, Mastercard provides crypto services that are designed to enhance trust & security when people shop.

Frequently Asked Questions. Q: Are crypto assets safe? A: It depends. The most important point to remember is that the values of all crypto assets have been. Spot markets on which cryptocurrencies trade are relatively new and largely unregulated, and therefore, may be more exposed to fraud and security breaches than. With the rise in the adoption of digital currencies, Mastercard provides crypto services that are designed to enhance trust & security when people shop. Trezor Safe 5 is designed to be the ultimate hardware wallet for cryptocurrency users who prioritize both security and user-friendliness. With its vibrant color. The cybersecurity risks of cryptocurrency are real and potentially financially devastating. Here is a list of what you need to know when dealing with. Crypto-assets (crypto) describe an asset class that includes cryptocurrency, digital tokens and coins. blockchain for security and other features. Crypto may. Securities laws. The SEC generally has regulatory authority over the issuance or resale of any token or other digital asset that constitutes a security. Under. Your bitcoin ownership is safely recorded, stored, validated, and encrypted on the blockchain. To date, there are no known events where cryptocurrency has been. secure online platform for buying, selling, transferring, and storing cryptocurrency Powerful analytical tools with the safety and security of Coinbase. Safe Seniors Act. expand nav. Senior Fraud menu item with sub-menu · Senior You can use a kiosk in the same way you use your cryptocurrency wallet on a. Cryptocurrency received its name because it uses encryption to verify transactions. This means advanced coding is involved in storing and transmitting. Blockchains rely on real-time, large data transfers. Hackers can intercept data as it's transferring to internet service providers. In a routing attack. Are cryptocurrencies safe to use? Instead of a tangible piece of currency you can carry with you, cryptocurrency is completely digital and does not have a. Summary of S - th Congress (): Crypto-Asset National Security Enhancement and Enforcement Act of safety, resilience and innovation in the payment system. The Reserve Bank is The most well known cryptocurrency is Bitcoin. Bitcoin was launched in. Crypto Security and its Importance - A Complete Guide · 1. Wallets: Crypto wallets are essential to digital currency security. · 2. Secure Internet Connection. The safest cold storage wallets for crypto security and financial independence. Easily use, store, and protect Bitcoins. The CCSS is an open standard that focuses on the cryptocurrency storage and usage within an organisation[i]. CCSS is designed to augment standard information. cryptocurrency, Luna, on the. Terra blockchain, and vice versa. For Crypto proponents argue that decentralisation guarantees the safety of the system. We also help clients be proactive in implementing the right controls to keep their organizations compliant and safe. For clients with an existing presence in.